55 Repositories

Python risk-factors Libraries

Pre-crisis Risk Management for Personal Finance

Антикризисный риск-менеджмент личных финансов Риск-менеджмент личных финансов условиях санкций и/или финансового кризиса: делаем сегодня все, чтобы за

GARCH and Multivariate LSTM forecasting models for Bitcoin realized volatility with potential applications in crypto options trading, hedging, portfolio management, and risk management

Bitcoin Realized Volatility Forecasting with GARCH and Multivariate LSTM Author: Chi Bui This Repository Repository Directory ├── README.md

In this project, RandomOverSampler and SMOTE algorithms were used to perform oversampling, ClusterCentroids algorithm was used to undersampling, SMOTEENN algorithm was applied as a combinatorial approach of over- and undersampling of credit card credit dataset from LendingClub. Machine learning models - BalancedRandomForestClassifier and EasyEnsembleClassifier were used to predict credit risk.

Overview of Credit Card Analysis In this project, RandomOverSampler and SMOTE algorithms were used to perform oversampling, ClusterCentroids algorithm

Code needed to reproduce the examples found in "The Temporal Robustness of Stochastic Signals"

The Temporal Robustness of Stochastic Signals Code needed to reproduce the examples found in "The Temporal Robustness of Stochastic Signals" Case stud

Recommender systems are the systems that are designed to recommend things to the user based on many different factors

Recommender systems are the systems that are designed to recommend things to the user based on many different factors. The recommender system deals with a large volume of information present by filtering the most important information based on the data provided by a user and other factors that take care of the user’s preference and interest.

Driver Analysis with Factors and Forests: An Automated Data Science Tool using Python

Driver Analysis with Factors and Forests: An Automated Data Science Tool using Python 📊

Script to autocompound 3commas BO:SO based on user provided risk factor

3commas_compounder Script to autocompound 3commas BO:SO based on user provided risk factor Setup Step 1 git clone this repo into your working director

LERP : Label-dependent and event-guided interpretable disease risk prediction using EHRs

LERP : Label-dependent and event-guided interpretable disease risk prediction using EHRs This is the code for the LERP. Dataset The dataset used is MI

Pynomial - a lightweight python library for implementing the many confidence intervals for the risk parameter of a binomial model

Pynomial - a lightweight python library for implementing the many confidence intervals for the risk parameter of a binomial model

This is an open solution to the Home Credit Default Risk challenge 🏡

Home Credit Default Risk: Open Solution This is an open solution to the Home Credit Default Risk challenge 🏡 . More competitions 🎇 Check collection

Mortality risk prediction for COVID-19 patients using XGBoost models

Mortality risk prediction for COVID-19 patients using XGBoost models Using demographic and lab test data received from the HM Hospitales in Spain, I b

Credit EDA Case Study Using Python

This case study aims to identify patterns which indicate if a client has difficulty paying their installments which may be used for taking actions such as denying the loan, reducing the amount of loan, lending (to risky applicants) at a higher interest rate, etc

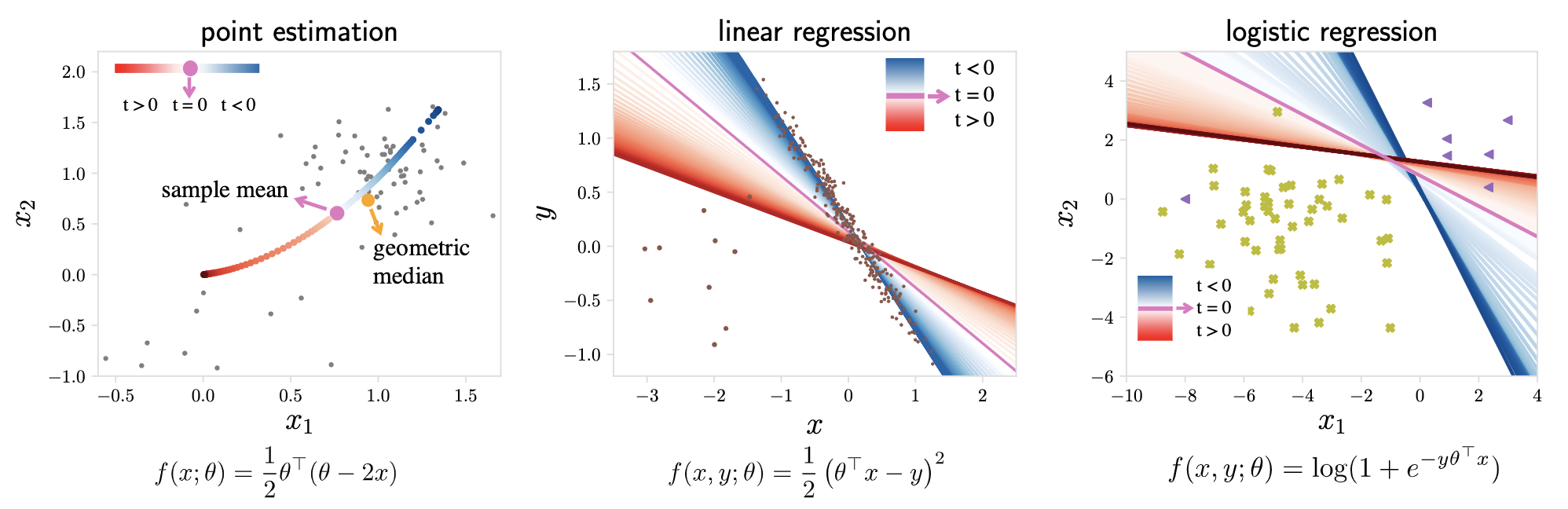

Code accompanying the paper on "An Empirical Investigation of Domain Generalization with Empirical Risk Minimizers" published at NeurIPS, 2021

Code for "An Empirical Investigation of Domian Generalization with Empirical Risk Minimizers" (NeurIPS 2021) Motivation and Introduction Domain Genera

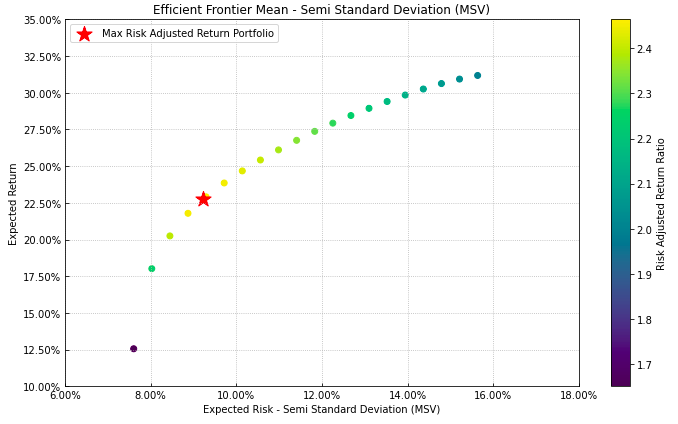

Financial portfolio optimisation in python, including classical efficient frontier, Black-Litterman, Hierarchical Risk Parity

PyPortfolioOpt has recently been published in the Journal of Open Source Software 🎉 PyPortfolioOpt is a library that implements portfolio optimizatio

This repository contains the code for designing risk bounded motion plans for car-like robot using Carla Simulator.

Nonlinear Risk Bounded Robot Motion Planning This code simulates the bicycle dynamics of car by steering it on the road by avoiding another static car

Given a list of tickers, this algorithm generates a recommended portfolio for high-risk investors.

RiskyPortfolioGenerator Given a list of tickers, this algorithm generates a recommended portfolio for high-risk investors. Working in a group, we crea

This project used bitcoin, S&P500, and gold to construct an investment portfolio that aimed to minimize risk by minimizing variance.

minvar_invest_portfolio This project used bitcoin, S&P500, and gold to construct an investment portfolio that aimed to minimize risk by minimizing var

A library to generate synthetic time series data by easy-to-use factors and generator

timeseries-generator This repository consists of a python packages that generates synthetic time series dataset in a generic way (under /timeseries_ge

Out-of-Distribution Generalization of Chest X-ray Using Risk Extrapolation

OoD_Gen-Chest_Xray Out-of-Distribution Generalization of Chest X-ray Using Risk Extrapolation Requirements (Installations) Install the following libra

Pytorch implementation of the AAAI 2022 paper "Cross-Domain Empirical Risk Minimization for Unbiased Long-tailed Classification"

[AAAI22] Cross-Domain Empirical Risk Minimization for Unbiased Long-tailed Classification We point out the overlooked unbiasedness in long-tailed clas

OpenQuake's Engine for Seismic Hazard and Risk Analysis

OpenQuake Engine The OpenQuake Engine is an open source application that allows users to compute seismic hazard and seismic risk of earthquakes on a g

Understanding the Properties of Minimum Bayes Risk Decoding in Neural Machine Translation.

Understanding Minimum Bayes Risk Decoding This repo provides code and documentation for the following paper: Müller and Sennrich (2021): Understanding

A repository with exploration into using transformers to predict DNA ↔ transcription factor binding

Transcription Factor binding predictions with Attention and Transformers A repository with exploration into using transformers to predict DNA ↔ transc

![[AAAI 2022] Separate Contrastive Learning for Organs-at-Risk and Gross-Tumor-Volume Segmentation with Limited Annotation](https://github.com/jcwang123/Separate_CL/raw/main/framework.png)

[AAAI 2022] Separate Contrastive Learning for Organs-at-Risk and Gross-Tumor-Volume Segmentation with Limited Annotation

A paper Introduction This is an official release of the paper Separate Contrastive Learning for Organs-at-Risk and Gross-Tumor-Volume Segmentation wit

This is the old code for bitcoin risk metric, the whole purpose form it is to help you DCA your investment according to bitcoin risk.

About The Project This is the old code for bitcoin risk metric, the whole purpose form it is to help you DCA your investment according to bitcoin risk

Agile Threat Modeling Toolkit

Threagile is an open-source toolkit for agile threat modeling:

Optimizing Value-at-Risk and Conditional Value-at-Risk of Black Box Functions with Lacing Values (LV)

BayesOpt-LV Optimizing Value-at-Risk and Conditional Value-at-Risk of Black Box Functions with Lacing Values (LV) About This repository contains the s

Code for "Optimizing risk-based breast cancer screening policies with reinforcement learning"

Tempo: Optimizing risk-based breast cancer screening policies with reinforcement learning Introduction This repository was used to develop Tempo, as d

Portfolio Optimization and Quantitative Strategic Asset Allocation in Python

Riskfolio-Lib Quantitative Strategic Asset Allocation, Easy for Everyone. Description Riskfolio-Lib is a library for making quantitative strategic ass

Epidemiology analysis package

zEpid zEpid is an epidemiology analysis package, providing easy to use tools for epidemiologists coding in Python 3.5+. The purpose of this library is

Python beta calculator that retrieves stock and market data and provides linear regressions.

Stock and Index Beta Calculator Python script that calculates the beta (β) of a stock against the chosen index. The script retrieves the data and resa

A Game-Theoretic Perspective on Risk-Sensitive Reinforcement Learning

Officile code repository for "A Game-Theoretic Perspective on Risk-Sensitive Reinforcement Learning"

Officile code repository for "A Game-Theoretic Perspective on Risk-Sensitive Reinforcement Learning"

CvarAdversarialRL Official code repository for "A Game-Theoretic Perspective on Risk-Sensitive Reinforcement Learning". Initial setup Create a virtual

vartests is a Python library to perform some statistic tests to evaluate Value at Risk (VaR) Models

vartests is a Python library to perform some statistic tests to evaluate Value at Risk (VaR) Models, such as: T-test: verify if mean of distribution i

Oh365UserFinder is used for identifying valid o365 accounts without the risk of account lockouts.

Oh365 User Finder Oh365UserFinder is used for identifying valid o365 accounts without the risk of account lockouts. The tool parses responses to ident

DeepSTD: Mining Spatio-temporal Disturbances of Multiple Context Factors for Citywide Traffic Flow Prediction

DeepSTD: Mining Spatio-temporal Disturbances of Multiple Context Factors for Citywide Traffic Flow Prediction This is the implementation of DeepSTD in

An automated Risk Management Monitor Bot for ByBit cryptocurrencies exchange.

An automated Risk Management Monitor Bot for ByBit cryptocurrencies exchange that forces all open positions to adhere to a specific risk ratio, defined per asset. It supports USDT Perpetual, Inverse Perpetual and Inverse Futures all on Mainnet and Testnet.

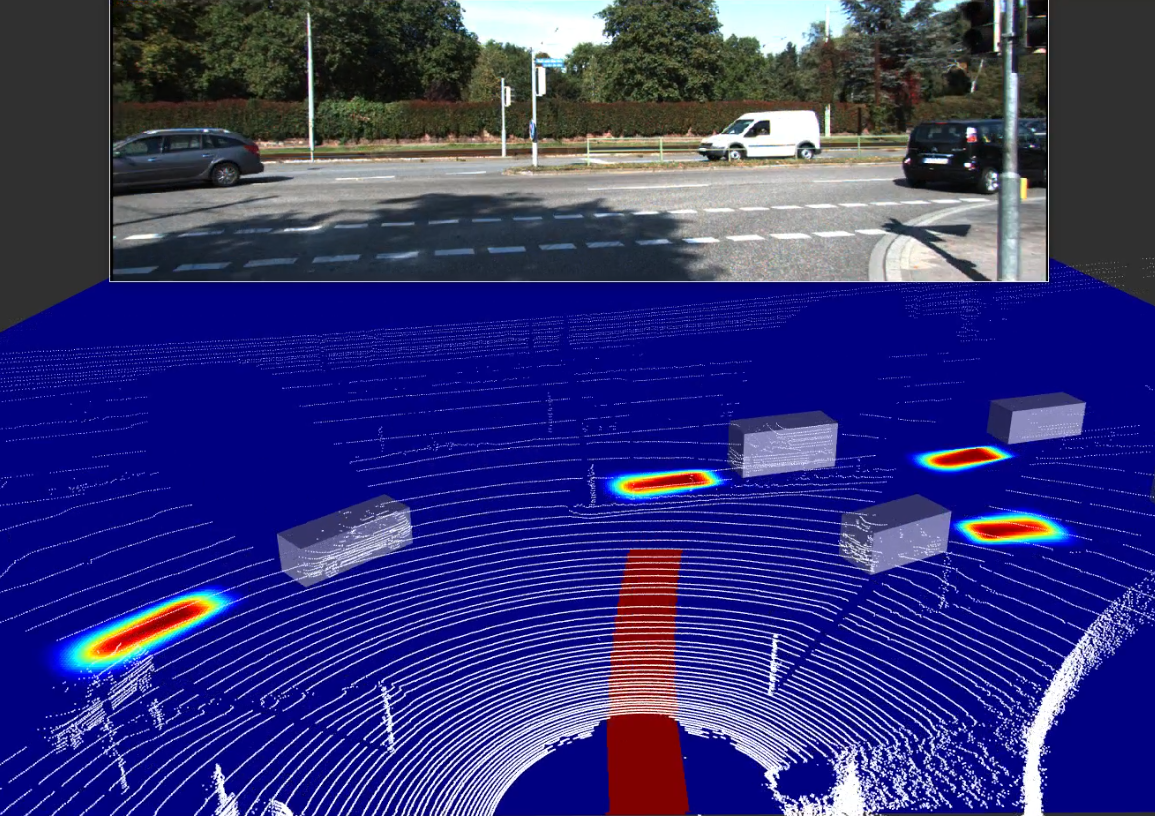

Collision risk estimation using stochastic motion models

collision_risk_estimation Collision risk estimation using stochastic motion models. This is a new approach, based on stochastic models, to predict the

Agent-based model simulator for air quality and pandemic risk assessment in architectural spaces

Agent-based model simulation for air quality and pandemic risk assessment in architectural spaces. User Guide archABM is a fast and open source agent-

The code for our NeurIPS 2021 paper "Kernelized Heterogeneous Risk Minimization".

Kernelized-HRM Jiashuo Liu, Zheyuan Hu The code for our NeurIPS 2021 paper "Kernelized Heterogeneous Risk Minimization"[1]. This repo contains the cod

A lightweight Python-based 3D network multi-agent simulator. Uses a cell-based congestion model. Calculates risk, loudness and battery capacities of the agents. Suitable for 3D network optimization tasks.

AMAZ3DSim AMAZ3DSim is a lightweight python-based 3D network multi-agent simulator. It uses a cell-based congestion model. It calculates risk, battery

![Moiré Attack (MA): A New Potential Risk of Screen Photos [NeurIPS 2021]](https://github.com/Dantong88/Moire_Attack/raw/main/Images/Pipeline.png)

Moiré Attack (MA): A New Potential Risk of Screen Photos [NeurIPS 2021]

Moiré Attack (MA): A New Potential Risk of Screen Photos [NeurIPS 2021] This repository is the official implementation of Moiré Attack (MA): A New Pot

Investment and risk technologies maintained by Fortitudo Technologies.

Fortitudo Technologies Open Source This package allows you to freely explore open-source implementations of some of our fundamental technologies under

Companion code for "Bayesian logistic regression for online recalibration and revision of risk prediction models with performance guarantees"

Companion code for "Bayesian logistic regression for online recalibration and revision of risk prediction models with performance guarantees" Installa

Code and project page for ICCV 2021 paper "DisUnknown: Distilling Unknown Factors for Disentanglement Learning"

DisUnknown: Distilling Unknown Factors for Disentanglement Learning See introduction on our project page Requirements PyTorch = 1.8.0 torch.linalg.ei

NHS AI Lab Skunkworks project: Long Stayer Risk Stratification

NHS AI Lab Skunkworks project: Long Stayer Risk Stratification A pilot project for the NHS AI Lab Skunkworks team, Long Stayer Risk Stratification use

A PyTorch implementation of the paper Mixup: Beyond Empirical Risk Minimization in PyTorch

Mixup: Beyond Empirical Risk Minimization in PyTorch This is an unofficial PyTorch implementation of mixup: Beyond Empirical Risk Minimization. The co

Tilted Empirical Risk Minimization (ICLR '21)

Tilted Empirical Risk Minimization This repository contains the implementation for the paper Tilted Empirical Risk Minimization ICLR 2021 Empirical ri

ARCH models in Python

arch Autoregressive Conditional Heteroskedasticity (ARCH) and other tools for financial econometrics, written in Python (with Cython and/or Numba used

Performance analysis of predictive (alpha) stock factors

Alphalens Alphalens is a Python Library for performance analysis of predictive (alpha) stock factors. Alphalens works great with the Zipline open sour

Common financial risk and performance metrics. Used by zipline and pyfolio.

empyrical Common financial risk metrics. Table of Contents Installation Usage Support Contributing Testing Installation pip install empyrical Usage S

Portfolio and risk analytics in Python

pyfolio pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian Inc. It works well with the Zipl

"Very simple but works well" Computer Vision based ID verification solution provided by LibraX.

ID Verification by LibraX.ai This is the first free Identity verification in the market. LibraX.ai is an identity verification platform for developers

Performance analysis of predictive (alpha) stock factors

Alphalens Alphalens is a Python Library for performance analysis of predictive (alpha) stock factors. Alphalens works great with the Zipline open sour

The earliest beta version of pytgcalls on Linux x86_64 and ARM64! Use in production at your own risk!

Public beta test. Use in production at your own risk! tgcalls - a python binding for tgcalls (c++ lib by Telegram); pytgcalls - library connecting pyt