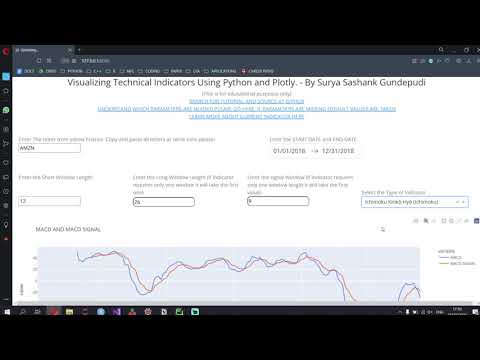

Visualizing Technical Indicators Using Python and Plotly.

Currently facing issues hosting the application on heroku. As soon as I am able to I'll like the live application here. Until then please check the demo below.

Please refer to the demo video below to understand how it works. (No audio available for the damo)

This is version 1 of the web applicaiton

About the Web app.

With this web applicaiton I aim to provide a free open source method for people to visualize and understand various technical indicators. People can use this applicaiton to select various technical indicators and then visualize and interact with them. This can help new financial engineers get a better understanding of how various parameters of a technical indicator will affect the way we execute trades. It uses the technical analysis library available for python and Plotly's interactive visualization tools to provide the user with a dynamically changing and interactive tool.

Since this is just version 1 of the application I am yet to fix a lot of bugs and improve on it. So do bear with some of the little nuances. In case you would like to send any suggestions please email me at [email protected].

Some features

- Interactive visualization

- Dynamically changing environment

- Users can look up the indicator with the link provided

- Any stock across yahoo finance is available

Tutorial on how to use the application.

To use this one must follow the steps below

- Open the web applicaiton in your browser

- Open Yahoo finance and search for the stock for which you wish to plot the indicator for

- Copy the ticker value for the stock from Yahoo FInance

- Paste it in the input box of the applicaiton

- Select the indicator.

- Select the date range and other input parameters based on the indicator

- In case you would like to learn more about the indicator click on the link that says "TO learn more about current indicator please click here"

For any suggestions please email me.

Indicators as of Version 1 of the web application.

1. Accumulation/Distribution Index

2. Aroon Indicator

3. Average Directional index

4. Average True Range (ATR)

5. Awesome Oscillator

6. Bollinger Bands (std - 2)

7. Chaikin Money Flow (CMF)

8. Cummilative Return

9. Daily Return

10. Donchian Channel Bands

11. Ease of Movement

12. Exponential Moving Average

13. Ichimoku Kinkō Hyō (Ichimoku)

14. Kaufman’s Adaptive Moving Average', 'value': 'KAMA'},

15. Kelter Channel Index

16. Money Flow index

17. MACD

18. Negative Volume Index Indicator

19. Percentage Price Oscillator

20. Percentage Volume Oscillator

21. Rate of Change

22. Relative Strength Index (RSI)

23. Simple Moving Average

24. Ulcer Index

25. Volume Weighted Average Price

26. Weighted Moving Average

This web application is made for academic purposes only

/dotdash_Final_Technical_Analysis_Strategies_for_Beginners_Sep_2020-01-2fd259fdcac044dd824d1b565e53b4e6.jpg)