101 Repositories

Python investment-strategies Libraries

A Python-based development platform for automated trading systems - from backtesting to optimisation to livetrading.

AutoTrader AutoTrader is Python-based platform intended to help in the development, optimisation and deployment of automated trading systems. From sim

Automatically deploy freqtrade to a remote Docker host and auto update strategies.

Freqtrade Automatically deploy freqtrade to a remote Docker host and auto update strategies. I've been using it to automatically deploy to vultr, but

Setup freqtrade/freqUI on Heroku

UNMAINTAINED - REPO MOVED TO https://github.com/p-zombie/freqtrade Creating the app git clone https://github.com/joaorafaelm/freqtrade.git && cd freqt

Procedurally generated Oblique Strategies for writing your own Oblique Strategies

Procedurally generated Oblique Strategies for writing your own Oblique Strategies.

Oblique Strategies for Python

Oblique Strategies for Python

CBO uses its Capital Tax model (CBO-CapTax) to estimate the effects of federal taxes on capital income from new investment

CBO’s CapTax Model CBO uses its Capital Tax model (CBO-CapTax) to estimate the effects of federal taxes on capital income from new investment. Specifi

This repository is the code of the paper Accelerating Deep Reinforcement Learning for Digital Twin Network Optimization with Evolutionary Strategies

ES_OTN_Public Carlos Güemes Palau, Paul Almasan, Pere Barlet Ros, Albert Cabellos Aparicio Contact us: [email protected], contactus@bn

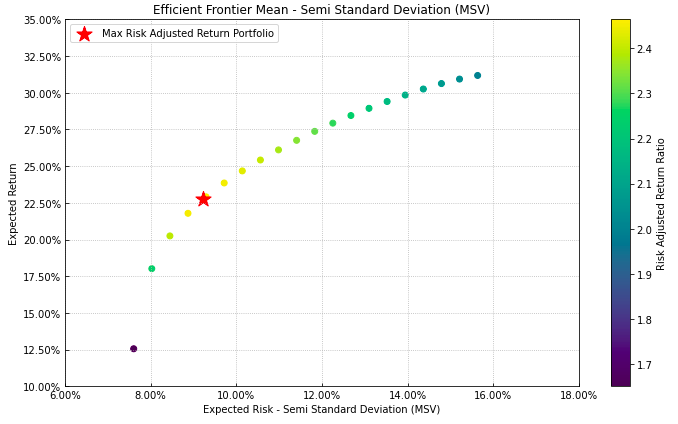

Portfolio asset allocation strategies: from Markowitz to RNNs

Portfolio asset allocation strategies: from Markowitz to RNNs Research project to explore different approaches for optimal portfolio allocation starti

Margin Calculator - Personally tailored investment tool

Margin Calculator - Personally tailored investment tool

Code for You Only Cut Once: Boosting Data Augmentation with a Single Cut

You Only Cut Once (YOCO) YOCO is a simple method/strategy of performing augmenta

Novel and high-performance medical image classification pipelines are heavily utilizing ensemble learning strategies

An Analysis on Ensemble Learning optimized Medical Image Classification with Deep Convolutional Neural Networks Novel and high-performance medical ima

Portfolio-tracker - This serverless application let's you keep track of your investment portfolios

Portfolio-tracker - This serverless application let's you keep track of your investment portfolios

Me and @nathanmargni did a small analysis on what are the best strategies to win more games of League of Legends.

Me and @nathanmargni did a small analysis on what are the best strategies to win more games of League of Legends.

Quant & Systematic Crypto Research Tools

qsec Quant & Systematic Crypto Research Tools --WORK IN PROGRESS-- This repo is a collection of research tools to help in exploring and building sys

Python-based implementation and comparison of strategies to guess words at Wordle

Solver and comparison of strategies for Wordle Motivation The goal of this repository is to compare, in terms of performance, strategies that minimize

The PyTorch implementation of paper REST: Debiased Social Recommendation via Reconstructing Exposure Strategies

REST The PyTorch implementation of paper REST: Debiased Social Recommendation via Reconstructing Exposure Strategies. Usage Download dataset Download

Financial portfolio optimisation in python, including classical efficient frontier, Black-Litterman, Hierarchical Risk Parity

PyPortfolioOpt has recently been published in the Journal of Open Source Software 🎉 PyPortfolioOpt is a library that implements portfolio optimizatio

A python command line tool to calculate options max pain for a given company symbol and options expiry date.

Options-Max-Pain-Calculator A python command line tool to calculate options max pain for a given company symbol and options expiry date. Overview - Ma

Free python/telegram bot for easy execution and surveillance of crypto trading plans on multiple exchanges.

EazeBot Introduction Have you ever traded cryptocurrencies and lost overview of your planned buys/sells? Have you encountered the experience that your

Machine Learning in Asset Management (by @firmai)

Machine Learning in Asset Management If you like this type of content then visit ML Quant site below: https://www.ml-quant.com/ Part One Follow this l

This project used bitcoin, S&P500, and gold to construct an investment portfolio that aimed to minimize risk by minimizing variance.

minvar_invest_portfolio This project used bitcoin, S&P500, and gold to construct an investment portfolio that aimed to minimize risk by minimizing var

An e-commerce company wants to segment its customers and determine marketing strategies according to these segments.

customer_segmentation_with_rfm Business Problem : An e-commerce company wants to

Cryptocurrency Trading Bot - A trading bot to automate cryptocurrency trading strategies using Python, equipped with a basic GUI

Cryptocurrency Trading Bot - A trading bot to automate cryptocurrency trading strategies using Python, equipped with a basic GUI. Used REST and WebSocket API to connect to two of the most popular crypto exchanges in the world.

Blankly - 🚀 💸 Trade stocks, cryptos, and forex w/ one package. Easily build, backtest, trade, and deploy across exchanges in a few lines of code.

💨 Rapidly build and deploy quantitative models for stocks, crypto, and forex 🚀 View Docs · Our Website · Join Our Newsletter · Getting Started Why B

Fastquant - Backtest and optimize your trading strategies with only 3 lines of code!

fastquant 🤓 Bringing backtesting to the mainstream fastquant allows you to easily backtest investment strategies with as few as 3 lines of python cod

rebalance is a simple Python 3.9+ library for rebalancing investment portfolios

rebalance rebalance is a simple Python 3.9+ library for rebalancing investment portfolios. It supports cash flow rebalancing with contributions and wi

Technical_indicators_cryptos - Using technical indicators to find optimal trading strategies to deploy onto trading bot.

technical_indicators_cryptos Using technical indicators to find optimal trading strategies to deploy onto trading bot. In the Jup Notebook you wil

Beibo is a Python library that uses several AI prediction models to predict stocks returns over a defined period of time.

Beibo is a Python library that uses several AI prediction models to predict stocks returns over a defined period of time.

Trading Strategies (~50%) developed by GreenT on QuantConnect platform over the autumn quarter

Trading Strategies ~50% of codes from the Applied Financial Technology Course. Contributors: Claire W. Derrick T. Frank L. Utkarsh T. Course Leads: Dy

Versatile async-friendly library to retry failed operations with configurable backoff strategies

riprova riprova (meaning retry in Italian) is a small, general-purpose and versatile Python library that provides retry mechanisms with multiple backo

Hypothesis strategies for generating Python programs, something like CSmith

hypothesmith Hypothesis strategies for generating Python programs, something like CSmith. This is definitely pre-alpha, but if you want to play with i

Python SDK for LUSID by FINBOURNE, a bi-temporal investment management data platform with portfolio accounting capabilities.

LUSID® Python SDK This is the Python SDK for LUSID by FINBOURNE, a bi-temporal investment management data platform with portfolio accounting capabilit

Scrapes the Sun Life of Canada Philippines web site for historical prices of their investment funds and then saves them as CSV files.

slocpi-scraper Sun Life of Canada Philippines Inc Investment Funds Scraper Install dependencies pip install -r requirements.txt Usage General format:

Showing potential issues with merge strategies

Showing potential issues with merge strategies Context There are two branches in this repo: main and a feature branch feat/inverting-method (not the b

An advanced crypto trading bot written in Python

Jesse Jesse is an advanced crypto trading framework which aims to simplify researching and defining trading strategies. Why Jesse? In short, Jesse is

Custom Python code for calculating the Probability of Profit (POP) for options trading strategies using Monte Carlo Simulations.

Custom Python code for calculating the Probability of Profit (POP) for options trading strategies using Monte Carlo Simulations.

Implementation for Evolution of Strategies for Cooperation

Moraliser Implementation for Evolution of Strategies for Cooperation Dependencies You will need a python3 (= 3.8) environment to run the code. Before

This is the old code for bitcoin risk metric, the whole purpose form it is to help you DCA your investment according to bitcoin risk.

About The Project This is the old code for bitcoin risk metric, the whole purpose form it is to help you DCA your investment according to bitcoin risk

Convenient script for trading with python.

Convenient script for trading with python.

Official Implementation of DAFormer: Improving Network Architectures and Training Strategies for Domain-Adaptive Semantic Segmentation

DAFormer: Improving Network Architectures and Training Strategies for Domain-Adaptive Semantic Segmentation [Arxiv] [Paper] As acquiring pixel-wise an

Algorithmic trading backtest and optimization examples using order book imbalances. (bitcoin, cryptocurrency, bitmex)

Algorithmic trading backtest and optimization examples using order book imbalances. (bitcoin, cryptocurrency, bitmex)

Qlib is an AI-oriented quantitative investment platform

Qlib is an AI-oriented quantitative investment platform, which aims to realize the potential, empower the research, and create the value of AI technologies in quantitative investment.

Co-GAIL: Learning Diverse Strategies for Human-Robot Collaboration

CoGAIL Table of Content Overview Installation Dataset Training Evaluation Trained Checkpoints Acknowledgement Citations License Overview This reposito

Demo repository for Saltconf21 talk - Testing strategies for Salt states

Saltconf21 testing strategies Demonstration repository for my Saltconf21 talk "Strategies for testing Salt states" Talk recording Slides and demos Get

Portfolio Optimization and Quantitative Strategic Asset Allocation in Python

Riskfolio-Lib Quantitative Strategic Asset Allocation, Easy for Everyone. Description Riskfolio-Lib is a library for making quantitative strategic ass

A distributed deep learning framework that supports flexible parallelization strategies.

FlexFlow FlexFlow is a deep learning framework that accelerates distributed DNN training by automatically searching for efficient parallelization stra

Empyrial is a Python-based open-source quantitative investment library dedicated to financial institutions and retail investors

By Investors, For Investors. Want to read this in Chinese? Click here Empyrial is a Python-based open-source quantitative investment library dedicated

Use unsupervised and supervised learning to predict stocks

AIAlpha: Multilayer neural network architecture for stock return prediction This project is meant to be an advanced implementation of stacked neural n

Introducing neural networks to predict stock prices

IntroNeuralNetworks in Python: A Template Project IntroNeuralNetworks is a project that introduces neural networks and illustrates an example of how o

Fully Dockerized cryptocurrencies Trading Bot, based on Freqtrade engine. Multi instances.

Cryptocurrencies Trading Bot - Freqtrade Manager This automated Trading Bot is based on the amazing Freqtrade one. It allows you to manage many Freqtr

Statistical and Algorithmic Investing Strategies for Everyone

Eiten - Algorithmic Investing Strategies for Everyone Eiten is an open source toolkit by Tradytics that implements various statistical and algorithmic

Data Scientist in Simple Stock Analysis of PT Bukalapak.com Tbk for Long Term Investment

Data Scientist in Simple Stock Analysis of PT Bukalapak.com Tbk for Long Term Investment Brief explanation of PT Bukalapak.com Tbk Bukalapak was found

Co-GAIL: Learning Diverse Strategies for Human-Robot Collaboration

CoGAIL Table of Content Overview Installation Dataset Training Evaluation Trained Checkpoints Acknowledgement Citations License Overview This reposito

Guiding evolutionary strategies by (inaccurate) differentiable robot simulators @ NeurIPS, 4th Robot Learning Workshop

Guiding Evolutionary Strategies by Differentiable Robot Simulators In recent years, Evolutionary Strategies were actively explored in robotic tasks fo

A Factor Model for Persistence in Investment Manager Performance

Factor-Model-Manager-Performance A Factor Model for Persistence in Investment Manager Performance I apply methods and processes similar to those used

An execution framework for systematic strategies

WAGMI is an execution framework for systematic strategies. It is very much a work in progress, please don't expect it to work! Architecture The Django

Robotic hamster to give you financial advice

hampp Robotic hamster to give you financial advice. I am not liable for any advice that the hamster gives. Follow at your own peril. Description Hampp

A BlackJack simulator in Python to simulate thousands or millions of hands using different strategies.

BlackJack Simulator (in Python) A BlackJack simulator to play any number of hands using different strategies The Rules To keep the code relatively sim

Investment and risk technologies maintained by Fortitudo Technologies.

Fortitudo Technologies Open Source This package allows you to freely explore open-source implementations of some of our fundamental technologies under

Goddard A collection of small, simple strategies for Freqtrade

Goddard A collection of small, simple strategies for Freqtrade. Simply add the strategy you choose in your strategies folder and run. ⚠️ General Crypt

Multi-asset backtesting framework. An intuitive API lets analysts try out their strategies right away

Multi-asset backtesting framework. An intuitive API lets analysts try out their strategies right away. Fast execution of profit-take/loss-cut orders is built-in. Seamless with Pandas.

Building an Investment Portfolio for Day Trade with Python

Montando um Portfólio de Investimentos para Day Trade com Python Instruções: Para reproduzir o projeto no Google Colab, faça o download do repositório

Recommendations from Cramer: On the show Mad-Money (CNBC) Jim Cramer picks stocks which he recommends to buy. We will use this data to build a portfolio

Backtesting the "Cramer Effect" & Recommendations from Cramer Recommendations from Cramer: On the show Mad-Money (CNBC) Jim Cramer picks stocks which

A Trading strategy for the Freqtrade crypto bot.

Important Thing to notice 1) Do not use this strategy on live. It is still undergoing dry-run. 2) The Hyperopt is highly optimized towards "shitcoin"

Evolution Strategies in PyTorch

Evolution Strategies This is a PyTorch implementation of Evolution Strategies. Requirements Python 3.5, PyTorch = 0.2.0, numpy, gym, universe, cv2 Wh

Framework for creating and running trading strategies. Blatantly stolen copy of qtpylib to make it work for Indian markets.

_• Kinetick Trade Bot Kinetick is a framework for creating and running trading strategies without worrying about integration with broker and data str

In this Github repository I will share my freqtrade files with you. I want to help people with this repository who don't know Freqtrade so much yet.

My Freqtrade stuff In this Github repository I will share my freqtrade files with you. I want to help people with this repository who don't know Freqt

Auto-updating data to assist in investment to NEPSE

Symbol Ratios Summary Sector LTP Undervalued Bonus % MEGA Strong Commercial Banks 368 5 10 JBBL Strong Development Banks 568 5 10 SIFC Strong Finance

trading strategy for freqtrade crypto bot it base on CDC-ActionZone

ft-action-zone trading strategy for freqtrade crypto bot it base on CDC-ActionZone Indicator by piriya33 Clone The Repository if you just clone this r

Supplementary code for SIGGRAPH 2021 paper: Discovering Diverse Athletic Jumping Strategies

SIGGRAPH 2021: Discovering Diverse Athletic Jumping Strategies project page paper demo video Prerequisites Important Notes We suspect there are bugs i

My freqtrade strategies

My freqtrade-strategies Hi there! This is repo for my freqtrade-strategies. My name is Ilya Zelenchuk, I'm a lecturer at the SPbU university (https://

Gamestonk Terminal is an awesome stock and crypto market terminal

Gamestonk Terminal is an awesome stock and crypto market terminal. A FOSS alternative to Bloomberg Terminal.

Recommendation systems are among most widely preffered marketing strategies.

Recommendation systems are among most widely preffered marketing strategies. Their popularity comes from close prediction scores obtained from relationships of users and items. In this project, two recommendation systems are used for two different datasets: Association Recommendation Learning and Collaborative Filtering. Please read the description for more info.

How Do Adam and Training Strategies Help BNNs Optimization? In ICML 2021.

AdamBNN This is the pytorch implementation of our paper "How Do Adam and Training Strategies Help BNNs Optimization?", published in ICML 2021. In this

A Pancakeswap and Uniswap trading client (and bot) with limit orders, marker orders, stop-loss, custom gas strategies, a GUI and much more.

Pancakeswap and Uniswap trading client Adam A A Pancakeswap and Uniswap trading client (and bot) with market orders, limit orders, stop-loss, custom g

existing and custom freqtrade strategies supporting the new hyperstrategy format.

freqtrade-strategies Description Existing and self-developed strategies, rewritten to support the new HyperStrategy format from the freqtrade-develop

🔬 A curated list of awesome machine learning strategies & tools in financial market.

🔬 A curated list of awesome machine learning strategies & tools in financial market.

This is the official implementation of TrivialAugment and a mini-library for the application of multiple image augmentation strategies including RandAugment and TrivialAugment.

Trivial Augment This is the official implementation of TrivialAugment (https://arxiv.org/abs/2103.10158), as was used for the paper. TrivialAugment is

Optimize Trading Strategies Using Freqtrade

Optimize trading strategy using Freqtrade Short demo on building, testing and optimizing a trading strategy using Freqtrade. The DevBootstrap YouTube

PyTorch Implementation for AAAI'21 "Do Response Selection Models Really Know What's Next? Utterance Manipulation Strategies for Multi-turn Response Selection"

UMS for Multi-turn Response Selection Implements the model described in the following paper Do Response Selection Models Really Know What's Next? Utte

A Pancakeswap v2 trading client (and bot) with limit orders, stop-loss, custom gas strategies, a GUI and much more.

Pancakeswap v2 trading client A Pancakeswap trading client (and bot) with limit orders, stop-loss, custom gas strategies, a GUI and much more. If you

Tools for use in DeFi. Impermanent Loss calculations, staking and farming strategies, coingecko and pancakeswap API queries, liquidity pools and more

DeFi open source tools Get Started Instalation General Tools Impermanent Loss, simple calculation Compare Buy & Hold with Staking and Farming Complete

CryptoFrog - My First Strategy for freqtrade

cryptofrog-strategies CryptoFrog - My First Strategy for freqtrade NB: (2021-04-20) You'll need the latest freqtrade develop branch otherwise you migh

LiuAlgoTrader is a scalable, multi-process ML-ready framework for effective algorithmic trading

LiuAlgoTrader is a scalable, multi-process ML-ready framework for effective algorithmic trading. The framework simplify development, testing, deployment, analysis and training algo trading strategies. The framework automatically analyzes trading sessions, and the analysis may be used to train predictive models.

Using deep actor-critic model to learn best strategies in pair trading

Deep-Reinforcement-Learning-in-Stock-Trading Using deep actor-critic model to learn best strategies in pair trading Abstract Partially observed Markov

Introducing neural networks to predict stock prices

IntroNeuralNetworks in Python: A Template Project IntroNeuralNetworks is a project that introduces neural networks and illustrates an example of how o

Providing the solutions for high-frequency trading (HFT) strategies using data science approaches (Machine Learning) on Full Orderbook Tick Data.

Modeling High-Frequency Limit Order Book Dynamics Using Machine Learning Framework to capture the dynamics of high-frequency limit order books. Overvi

Use unsupervised and supervised learning to predict stocks

AIAlpha: Multilayer neural network architecture for stock return prediction This project is meant to be an advanced implementation of stacked neural n

Scalable, event-driven, deep-learning-friendly backtesting library

...Minimizing the mean square error on future experience. - Richard S. Sutton BTGym Scalable event-driven RL-friendly backtesting library. Build on

Trading and Backtesting environment for training reinforcement learning agent or simple rule base algo.

TradingGym TradingGym is a toolkit for training and backtesting the reinforcement learning algorithms. This was inspired by OpenAI Gym and imitated th

Trading Strategies for Freqtrade

Freqtrade Strategies Strategies for Freqtrade, developed primarily in a partnership between @werkkrew and @JimmyNixx from the Freqtrade Discord. Use t

Isn't that what we all want? Our money to go many? Well that's what this strategy hopes to do for you! By giving you/HyperOpt a lot of signals to alter the weight from.

#################################################################################### ####

Find big moving stocks before they move using machine learning and anomaly detection

Surpriver - Find High Moving Stocks before they Move Find high moving stocks before they move using anomaly detection and machine learning. Surpriver

:mag_right: :chart_with_upwards_trend: :snake: :moneybag: Backtest trading strategies in Python.

Backtesting.py Backtest trading strategies with Python. Project website Documentation the project if you use it. Installation $ pip install backtestin

Python Backtesting library for trading strategies

backtrader Yahoo API Note: [2018-11-16] After some testing it would seem that data downloads can be again relied upon over the web interface (or API v

Github.com/CryptoSignal - #1 Quant Trading & Technical Analysis Bot - 2,100 + stars, 580 + forks

CryptoSignal - #1 Quant Trading & Technical Analysis Bot - 2,100 + stars, 580 + forks https://github.com/CryptoSignal/Crypto-Signal Development state:

Qlib is an AI-oriented quantitative investment platform, which aims to realize the potential, empower the research, and create the value of AI technologies in quantitative investment. With Qlib, you can easily try your ideas to create better Quant investment strategies.

Qlib is an AI-oriented quantitative investment platform, which aims to realize the potential, empower the research, and create the value of AI technol

Python library for backtesting trading strategies & analyzing financial markets (formerly pythalesians)

finmarketpy (formerly pythalesians) finmarketpy is a Python based library that enables you to analyze market data and also to backtest trading strateg

A mini library for Policy Gradients with Parameter-based Exploration, with reference implementation of the ClipUp optimizer from NNAISENSE.

PGPElib A mini library for Policy Gradients with Parameter-based Exploration [1] and friends. This library serves as a clean re-implementation of the

Utilizing the freqtrade high-frequency cryptocurrency trading framework to build and optimize trading strategies. The bot runs nonstop on a Rasberry Pi.

Freqtrade Strategy Repository Please test all scripts and dry run them before using them in live mode Contact me on discord if you have any questions!